Bright Money - AI Debt Manager

Bright Money AI Debt Manager Helps Americans Save

Screenshots

Bright Money - AI Debt Manager

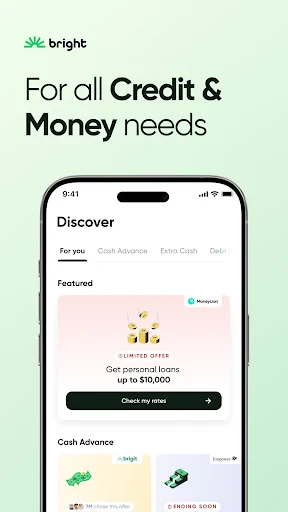

Have you ever wished for a reliable assistant to manage your finances and guide you through your debt repayment journey? Well, let me introduce you to an app that might just be your new best friend: Bright Money - AI Debt Manager. This app is like having a financial advisor in your pocket, and the best part? It's powered by AI, so you know it's got some serious smarts behind it.

Getting Your Finances Set Up with the App

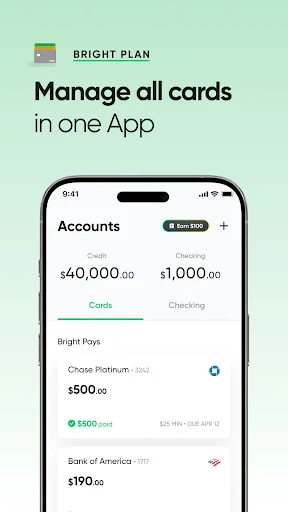

Jumping into Bright Money - AI Debt Manager is a breeze. The app walks you through a simple setup process, where you connect your bank accounts and credit cards. Don’t worry, it’s all secure and encrypted. Once you're in, the app starts analyzing your financial data to create a personalized plan to tackle your debts.

Exploring the App's Smart Tools

What sets Bright Money apart is its AI-driven insights. The app doesn’t just give you a generic plan; it crafts a strategy based on your unique spending habits and income. It suggests optimal payment plans and even points out potential savings. I found this feature incredibly useful because, let’s face it, financial planning can get overwhelming.

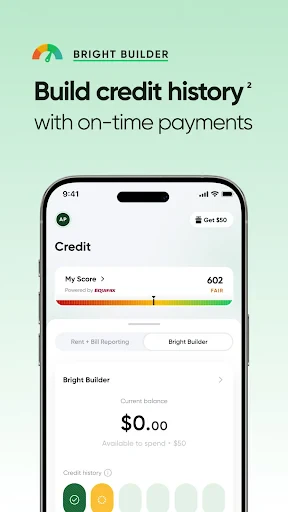

If you're someone who loves seeing progress, the app provides a clear visual representation of your debt repayment journey. You can track your progress with ease and even set reminders for payments. It’s like having a little cheerleader in your phone, motivating you to stay on track!

What Makes This App a Standout Choice

One of the things I personally love about Bright Money is how intuitive it is. You don’t need to be a financial guru to understand the data. The app breaks down complex financial jargon into simple, digestible bits. Plus, the interface is sleek and user-friendly, making navigation a breeze.

Another standout feature is the personalized advice. The app doesn’t just tell you to pay off your debts; it provides actionable steps and tips that are easy to follow. It’s like having a personalized financial coach who knows you inside out.

Wrapping Up the Review

In a world where managing debt can feel like a daunting task, Bright Money - AI Debt Manager offers a beacon of hope. It’s perfect for anyone looking to take control of their finances without the added stress. With its intuitive design, personalized advice, and robust security features, it’s an app that makes financial management feel less like a chore and more like a journey.

If you're ready to take the next step towards financial freedom, I’d highly recommend giving Bright Money a try. It might just be the tool you’ve been looking for to turn your financial dreams into reality.

Advantages

- User-friendly interface for easy navigation.

- AI-driven insights for personalized debt management.

- Secure data handling with encryption.

- Comprehensive budgeting tools included.

- Offers real-time financial tracking.

Disadvantages

- Requires internet connection for full functionality.

- Limited support for non-US financial institutions.

- Subscription needed for premium features.

- Occasional syncing issues with bank accounts.

- No option for manual data backup.

Frequently Asked Questions

Q: What is Bright Money and how does it help manage my debt?

A: Bright Money is an AI-driven financial app designed to help users manage and pay off their debts effectively. It uses advanced algorithms to analyze your financial situation and create personalized plans. By automating payments and offering insights into spending habits, it helps users reduce interest costs and pay off debts faster, enabling more efficient financial management.

Q: Is Bright Money safe to use with my financial information?

A: Yes, Bright Money prioritizes user security and data privacy. It employs bank-level encryption to protect your sensitive information. Additionally, the app does not store banking credentials and complies with industry regulations to safeguard user data. Users can rest assured that their financial information is secure while using the app.

Q: How does Bright Money's AI technology work to optimize my debt payments?

A: Bright Money uses proprietary AI technology that analyzes your income, expenses, and outstanding debts to create an optimized payment strategy. The AI identifies the best ways to allocate your funds, ensuring that you pay the least amount of interest over time. This technology helps users efficiently manage their finances and achieve debt-free living faster.

Q: Can Bright Money be used for both personal and business financial management?

A: Bright Money is primarily designed for personal financial management, focusing on helping individuals pay off personal debts. While it provides valuable insights and tools for personal use, it may not be suitable for managing business finances or debts. Users with business financial needs should consider tools specifically designed for business financial management.

Q: What are the costs associated with using Bright Money?

A: Bright Money offers a free version with basic features; however, to access premium services, users need to subscribe to the paid version. The premium plan offers enhanced features such as more detailed financial insights and personalized support. It's important for users to consider whether the additional features are worth the subscription cost based on their financial goals.

Technical Information

Recommended for You

AI Drawing : Trace & Sketch

ERG for Android

HeyJapan: Learn Japanese

Phonk Music - Song Remix Radio

Phone by Grice

Uber Pro Card

Invitation Maker

Pray Daily - KJV Bible & Verse

Coursera: Grow your career

Pray Alarm, Calendar & Bible

Reading Eggs - Learn to Read

Texture Maker for Minecraft PE

HungryPanda: Food Delivery

ToonMe photo cartoon maker

Jobber: Field Service Software

DSM-5-TR® Diagnostic Criteria

RaceTrac

LightCut -AI Auto Video Editor

Baby Names / First Names 2025

NASCAR MOBILE

StandBy PRO: Always On Display

Toomics - Read Premium Comics

Pi Browser