Affirm: Buy now, pay over time

Flexible payments for mindful shoppers budget responsibly

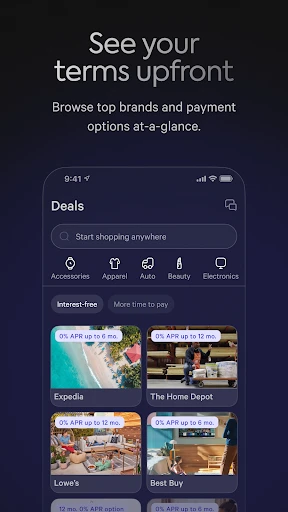

Screenshots

Ever found yourself eyeing something online but not quite ready to commit to the full price tag? Enter Affirm, the app that allows you to buy now and pay over time. If you’re anything like me, you’ll appreciate the flexibility this app brings to the table. Let’s dive into how it works and what makes it a must-have in your financial toolkit.

Understanding the Affirm App

Affirm is a financial service app that lets you split purchases into smaller, manageable payments. Think of it as your personal financial buddy that helps you spread the cost of that new gadget or wardrobe update over several months. Its seamless integration with various online retailers makes shopping a breeze.

How to Use Affirm for Your Purchases

Using Affirm is straightforward. Once you’ve got your eye on something, select Affirm at checkout. You’ll see a breakdown of payment plans, which is really handy for making informed decisions. Personally, I love seeing exactly what I’m getting into before I commit. Plus, there’s no hidden fees or penalties if you pay off early, which is a huge win in my book.

The Perks of Using This Payment Tool

First off, let’s talk about the user interface. It’s clean, intuitive, and super easy to navigate. Honestly, I’ve used a fair share of financial apps, and this one’s design is top-notch. Then there’s the approval process, which is quick and doesn’t leave you hanging. One minute you’re applying, and the next, you’re all set to shop!

How Secure is Your Information?

Security can be a concern with financial apps, but Affirm has you covered. With robust encryption and privacy controls, you can rest assured your personal information is safe. I’ve never had an issue with security while using the app, and that peace of mind is priceless.

Tailoring Payments to Your Budget

One thing that stands out for me is the flexibility Affirm offers. Whether you’re buying something small or splurging on a big-ticket item, being able to choose a payment plan that fits your budget is incredibly empowering. It’s like having the power to tailor your financial obligations to your lifestyle.

In conclusion, Affirm is a game-changer for anyone who wants to enjoy shopping without the immediate financial burden. Whether you’re a savvy shopper or someone who simply enjoys the flexibility of paying over time, this app has got your back. So next time you’re shopping online, give Affirm a go—your wallet will thank you!

Advantages

- Flexible payment plans available.

- User-friendly interface design.

- Quick approval process.

- No hidden fees involved.

- Wide acceptance in stores.

Disadvantages

- High interest rates on late payments.

- Limited to partnered retailers.

- Requires a credit check.

- Not available internationally.

- Potential for overspending.

Frequently Asked Questions

Q: What is Affirm and how does it work?

A: Affirm is a financing option available at many retailers that allows you to purchase items immediately and pay for them over time. When you choose Affirm at checkout, you can select from several payment plans, typically ranging from three to 36 months. Affirm conducts a soft credit check to determine your eligibility, which does not affect your credit score. Once approved, you can make monthly payments directly through the Affirm app or website.

Q: Does using Affirm affect my credit score?

A: Using Affirm will not impact your credit score as they perform a soft credit check during the loan approval process. However, it’s important to note that if you miss a payment or default on your loan, it could potentially affect your credit score negatively. Affirm reports to credit bureaus, so making timely payments can help improve your credit history.

Q: What are the interest rates and fees associated with Affirm?

A: Affirm offers transparent financing with no hidden fees. The interest rates vary depending on your creditworthiness and the retailer, typically ranging from 0% to 30% APR. Some promotions may offer 0% financing, which means you only pay the purchase price. Affirm does not charge late fees, service fees, or prepayment penalties, making it a straightforward financing option.

Q: Is Affirm available for all purchases?

A: Affirm is available at a wide range of retailers, but not every purchase qualifies for financing. The availability of Affirm as a payment option depends on the retailer's partnership with Affirm and the total purchase price. Typically, there is a minimum purchase requirement to use Affirm, and certain categories like gift cards are usually excluded from financing. Always check the retailer's checkout page to see if Affirm is offered.

Q: How do I make payments with Affirm?

A: You can make payments to Affirm easily through their mobile app or website. Once your purchase is confirmed, Affirm will notify you of your payment schedule via email and through the app. Payments can be made using a bank transfer, debit card, or check. The app also allows you to set up automatic payments to ensure you never miss a due date. Affirm sends reminders to help you stay on track with your payments.

Technical Information

Recommended for You

Music player

FaxCover Pro Create Cover Page

7shifts: Employee Scheduling

Moon Phase Calendar

Parcel Pending

Gamu: Emulator Console Game

Unlimited MP3 Music Downloader

AI Photo Editor - PhotoArt

VistaCreate: Graphic Design

Pathways.org Baby Milestones

Sofascore: Live Sports Scores

Safeco Mobile

ThemeKit - Themes & Widgets

LTK

Toters: Food Delivery & More

Anime Wallpaper HD 4K

Luzia: Your AI Assistant

السوق المفتوح - OpenSooq

Domino's Pizza USA

WFP 339 Ultra watch face

Crypto.com - Buy BTC, CRO, XRP

HubbleClub By Hubble Connected

RaceChrono Pro